Using Price Action To Predict Future Trends

This Python program takes in the price history of multiple cryptocurrencies such as Bitcoin, Ethereum, Litecoin, XRP and LINK over the past 5 years from a CSV file.

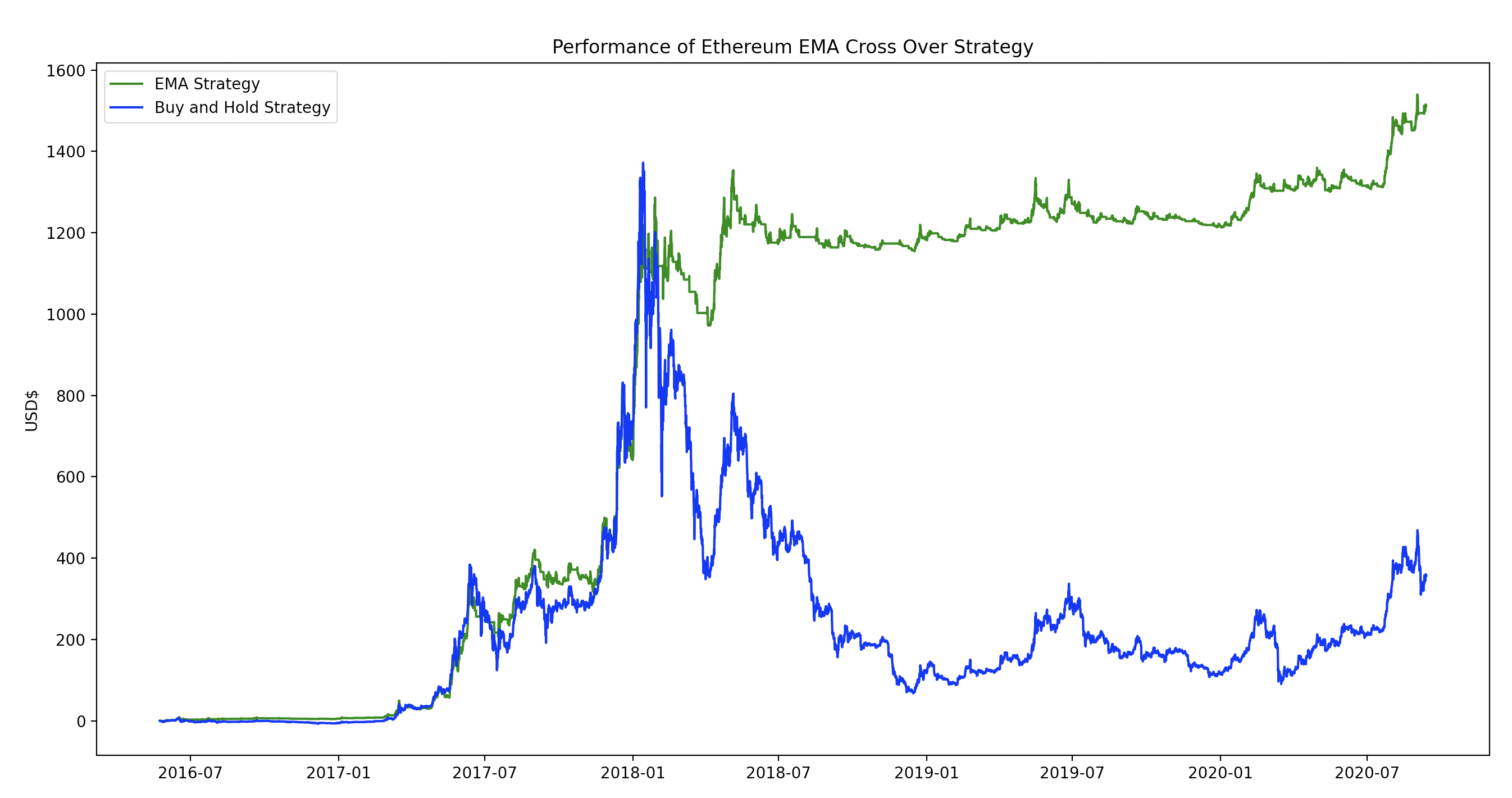

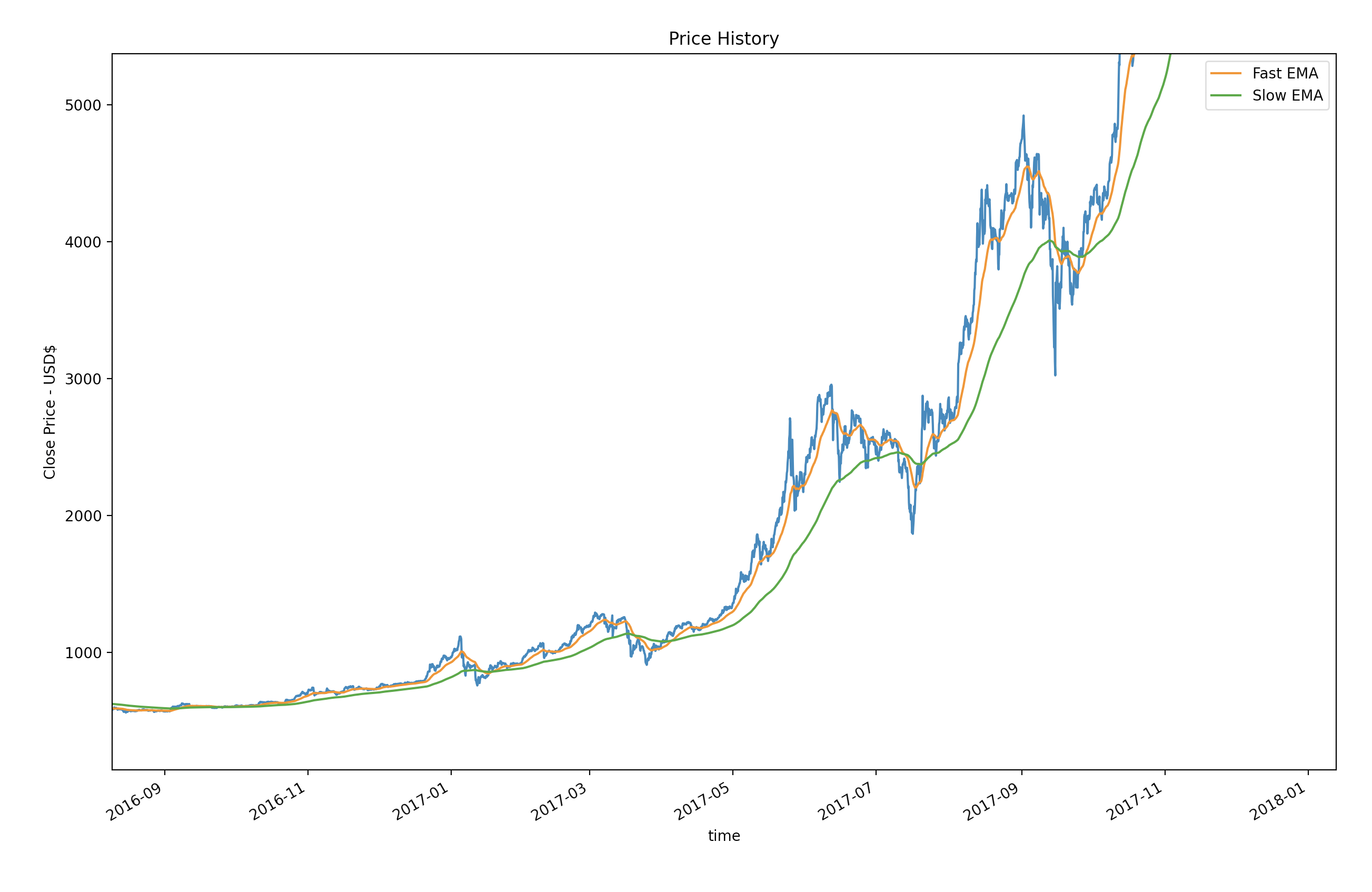

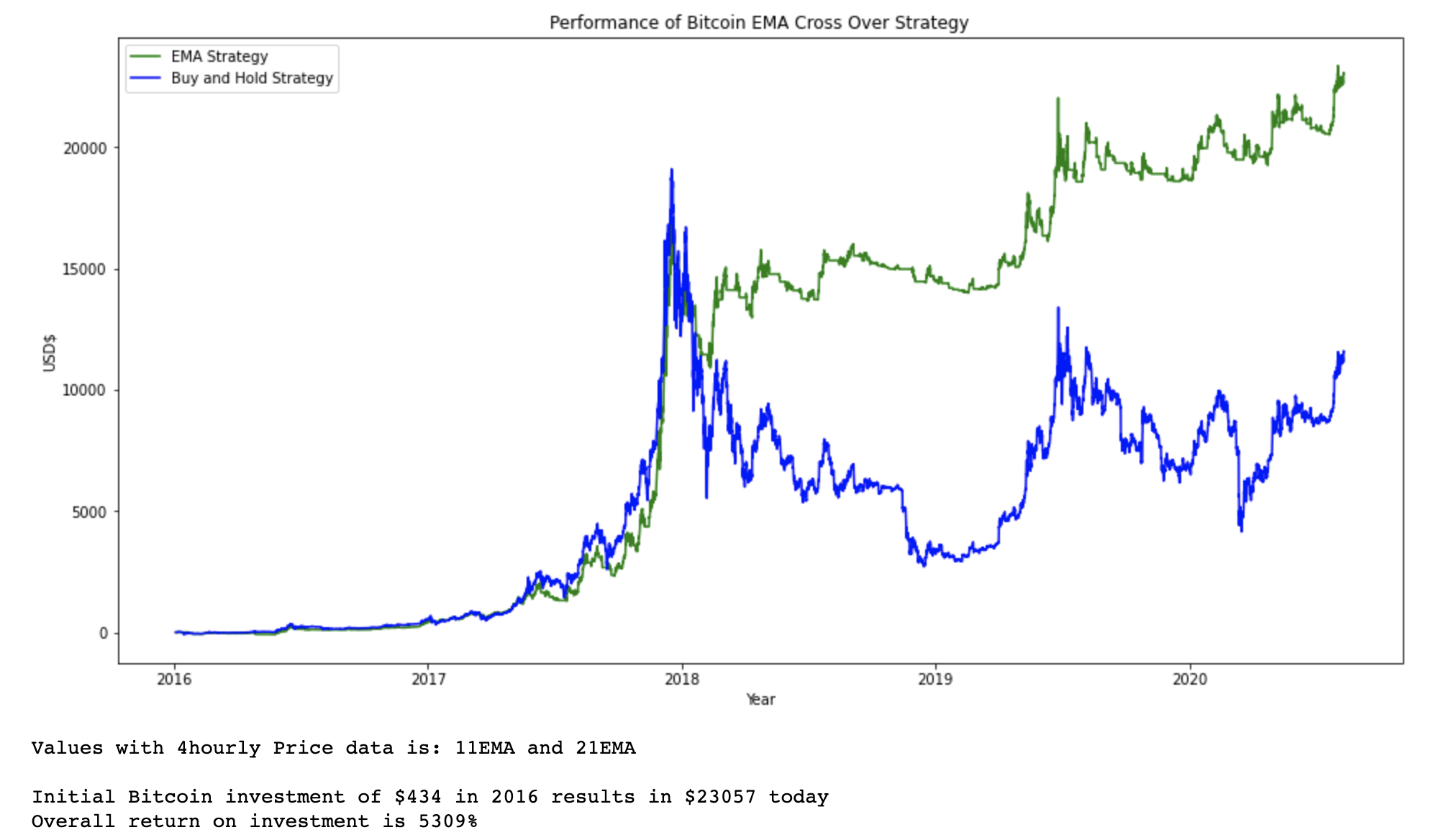

The trading strategy uses price momentum from a pair of Exponential Moving Averages crossover to signal when to buy and sell the asset over time (user specified). A user is able to input different length values for both EMA's to create faster or slower indicators for judging momentum, which is charted using Matplotlib over the time period.

By compounding the trading resultes the cumulative profit is charted together against a simple 'buy and hold' method for comparison, which the trading strategy far outperforms. Using Pandas dataframes for the calculations, user results are then stored in the Postgres Database, where we can then retrieve the highest ROI with different EMA's, with some exceeding over 10,000% return.

Note: These calculations were done in August 2020, and have not included the results of the bull run of the Oct-2020 to Apr-2021.